Introducing Imua: The Universal Protocol for Shared Security

TL;DR

- Imua is the universal protocol for shared security

- Imua has raised a $5M seed round

- Native re/staking for BTC, ETH, XRP, SOL, DOGE, TON and dozens more

- Introduces native yield to non-POS chains such as DOGE and XRP

- Uses simple one-way state mapping instead of traditional bridging

- Bundles economic security for developers to use for off-chain services

- Empowers developers to focus on building, not bootstrapping

- Expands shared security design space with new techniques

Imua has raised a $5M seed round

Imua, formerly known as Exocore, has raised a $5 million seed round led by Draper Dragon, No Limit Holdings, and Paramita Capital to launch the universal protocol for shared security. The round was oversubscribed, with participation from Reforge, Caladan, Tané Labs, Syntax Capital, JDAC, Alumni Ventures, MH Ventures, 57 Blocks, Lecca Ventures and others. Shima Capital provided early incubation support.

Why Imua?

The crypto industry is still fragmented, with blockchains that are isolated not only from each other but also from the rest of the world. The number of developers working full-time in web3 still trails web2 by several orders of magnitude.

The shortage of middleware services, which offer a layer of abstraction from intricate infrastructure, is a contributing factor to the scarcity of developers. This forces developers to build their own services, hindering the development of killer consumer apps. Additionally, the high overhead costs of bootstrapping web3 networks and services are a major obstacle for new developers entering the crypto ecosystem.

These issues mirror similar challenges faced in previous internet eras: in web1, developers had to set up their own TCP/IP networks; in web2, developers needed to configure server networks via data centers; and now in web3, developers must bootstrap entire token economies – all before achieving product-market fit for their core product use case.

“Imua” is a Hawaiian word that means “to move forward.” It was used by King Kamehameha I as a battle cry before uniting the tribalistic Hawaiian Islands in the early 1800's under a single governing body of shared security. In a similar fashion, Imua is unifying fragmented blockchains under a universal protocol for shared security.

What Is Imua?

Imua is the universal protocol for shared security. Implemented as a purpose-built L1 blockchain that addresses the challenges faced by developers in bootstrapping decentralized trust and security of their off-chain services.

Imua is built using Cosmos SDK and Tendermint BFT consensus. The native token $IMUA is used for re/staking, gas fees, and protocol governance, which can also come to agreement on intersubjective slashing conditions.

The innovation behind Imua lies not in its individual components, which are largely off-the-shelf and battle-tested, but in the way these components have been combined to create a universal protocol for shared security.

Imua bundles the economic security of major blockchain networks, which provides conditional trust via re/staking, and extends it to off-chain services who pay re/stakers to use it through yield.

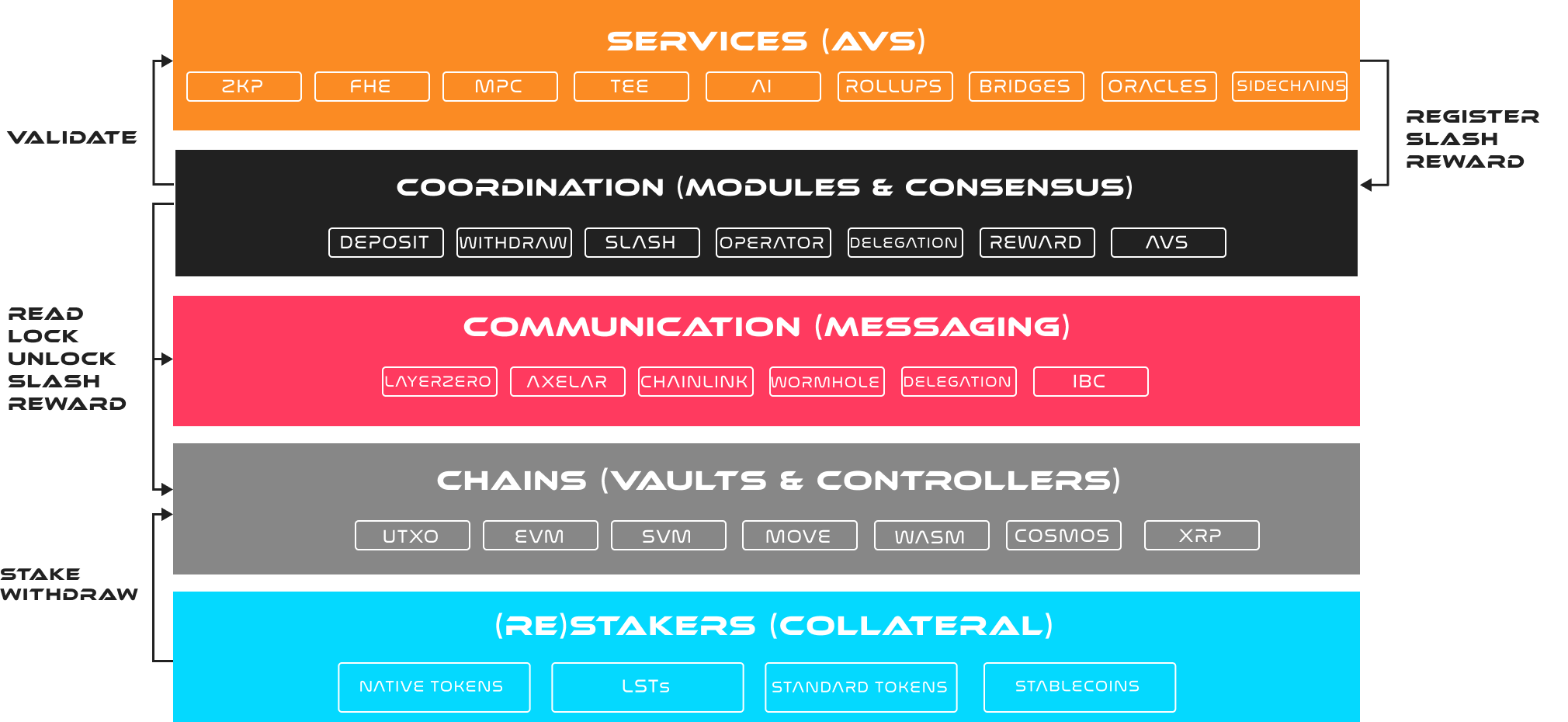

As a universal protocol for shared security, Imua handles all the complex staking and restaking logic (onboarding, deposits, locking, unlocking, slashing, accounting, claims, and rewards) at the protocol level rather than at the smart contract layer. This generalized approach reduces smart contract risk and allows for rapid horizontal scaling across many different chains.

Imua supports all the major blockchain execution environments including UTXO, EVM, SVM, MOVE, WASM, PBFT and more. For calculating voting power and streamlining accounting, Imua uses a dedicated enshrined oracle price feed, secured via BFT consensus, to normalize the weights (i.e., USD value) of the various tokens restaked on Imua.

Imua uses simple one-way state mapping via cross-chain communication protocols, such as LayerZero and Axelar, to send uni-directional messages to the underlying native chains to lock, unlock and slash tokens.

Imua reads the native chains via ZK light-clients and updates state on Imua via a queuing system that settles on an epoch. This design minimizes trust and solves the engineering concurrency risk of supporting both fast and slow chains simultaneously without sacrificing much performance. Use cases requiring higher throughput can be built as Imua appchains, which can scale to meet most specific performance needs.

The tokens re/staked on the native chains are never bridged or wrapped from the user’s wallet onto Imua, which means value accrues on the underlying L1 through fees. Also since Imua has its own dedicated consensus that can be used for resolving disagreements on slashing conditions, it doesn’t rely on the social consensus of other L1s as a backstop for resolving thorny slashing issues. These aspects help Imua maintain alignment with other L1 blockchains.

Ongoing research is being done to introduce re/staking insurance to further manage systemic risk of slashing.

Security by Design

We believe strong security design starts with the architecture. Security audits are essential but merely represent a snapshot of the system. Imua’s architecture puts security first through a number of key security design decisions:

- Simple Smart Contracts: Smart contract risk increases with complexity especially as more products are built on top of them. To mitigate this, Imua's smart contracts are designed to be simple and easily auditable (less lines of code). This is achieved by implementing complex restaking logic as individual modules at the Imua L1 protocol level, which is secured by Tendermint consensus.

- Trust Minimized Messaging: Imua uses ZK-light clients for trustless, unidirectional cross-chain communication. There are no third-party trust assumptions beyond the Imua chain itself and basic cryptographic primitives such as digital signatures and zero-knowledge proofs.

- Minimizing Attack Incentives: When restaking from their own wallet, users preset a withdrawal address, restricting claims to that address only, which cannot be updated. Alternatively, tokens can be sent to a black hole address for burning (slashing). This practically eliminates direct financial incentives for economically rational attackers to exploit the system. Even if the Imua chain were compromised, attackers could only burn, not withdraw, user funds.

- Battle-Tested Components: Imua uses a number of off-the-shelf, proven components like Cosmos SDK, Tendermint BFT consensus, and LayerZero with Polyhedra for ZK.

- Future Proof Through Modularity: Imua's design is highly modular, allowing its underlying components to be replaced with more secure or performant alternatives through protocol upgrades. This adaptability ensures that Imua remains a future-proof, decentralized system that is constantly evolving and improving.

Decentralized Trust-as-a-Service (dTaaS)

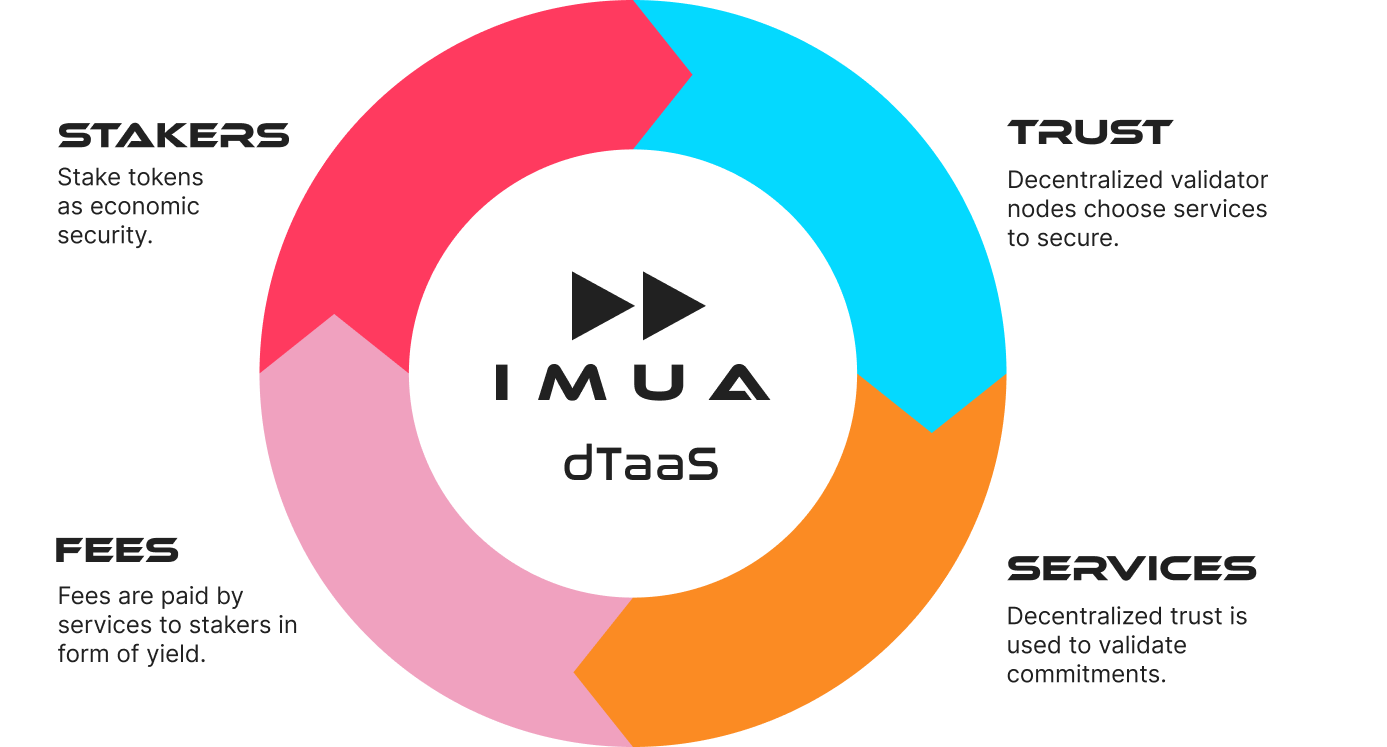

By combining economic and cryptographic security, Imua has formed an open protocol for decentralized Trust-as-a-Service (dTaaS).

Imua provides users access to new yield opportunities by allowing them to stake or restake dozens of token types, including BTC, ETH, XRP, SOL, DOGE, TON. Users then delegate their restaked tokens to an operator. The operator then selects from a variety of off-chain services, such as AI networks, games, cryptographic networks, bridges, oracles, appchains, sidechains, etc, to secure using the re/staked shared security. This grants developers instant access to the economic security of blockchains similar to how developers get instant access to compute via AWS or GCP. These services then use the re/staked shared security to validate commitments within their system and pay usage fees, which contributes to the yield earned by the users. This flow represents a classic flywheel that can grow as more re/stakers and services join Imua.

- Restakers increase available economic security

- An increase in available economic security attracts more services

- The more services, the more yield for restakers

- More yield attracts more restakers

Imua’s omnichain design avoids single chain volatility risk by indexing exposure to multiple blockchains and tokens. Even if a single token’s price drops or underperforms, Imua remains secure due to support from other chains.

What Can Be Built on Imua

Decentralized AI (DeAI)

The release of ChatGPT in December 2022 spurred a surge of developer activity for large language models (LLM) in AI. The intersection of crypto and AI is a key focus area for developers on Imua.

- The development of decentralized autonomous agents where agents use economic security to validate commitments (ie: agent 1 is instructed to pay no more than a certain threshold for a good or service) and guard against unwanted behavior (ie: agent 1 exceeds the payment threshold).

- Using Imua economic security to decentralize core components within an AI network, such as orchestrators, which consult the LLM on how to proceed with the task step by step. The desire for an AI network to be backed by decentralized economic security decreases the trust required for an orchestrator, as the economic security provides verifiability that the orchestrator is honoring its commitments to the users and not missing any steps.

Gaming

While web3 gaming has been an interesting use case for crypto, it has faced challenges due to the scalability limitations of most blockchains, which cannot support the throughput and low latency demands of massively multiplayer online games (MMOs), which are the most popular types of games played.

- Using Imua economic security, gaming infrastructure can still be run off-chain where it can scale infinitely, while also leveraging the token incentives of blockchains. Games are essentially highly performant marketplaces where trading of skins occurs in-game. These marketplaces could leverage token standards to create tokenized skins, resulting in a hybrid on-chain and off-chain gaming experience. This would contribute greatly to more blockchain transactions, where every in-game transaction would be settled on-chain.

DeFi Infrastructure

Historically, DeFi drives more developer activity in crypto than any other use case. DeFi thrives off the concept of using “money legos” to rebuild new financial systems using blockchains.

- Staking and restaking yield are fundamental components of the money lego stack. They create a benchmark rate in token economies, similar to treasury bond rates in traditional finance. Liquid Staking Tokens (LSTs) and Liquid Restaking Tokens (LRTs) are receipt tokens representing staked and restaked tokens that are locked up. These tokens have led to innovative yield stacking strategies, allowing users to boost capital efficiency, and access more yield. Using Imua, users can bundle yield across the various blockchains that Imua supports, which reduces DeFi liquidity fragmentation.

- A healthy DeFi market requires certain building blocks, including bridges that connect blockchains for interoperability and oracles that bring off-chain data, such as price feeds, on-chain. A key problem with both of these components is they require a high degree of trust, which creates a single point of failure, resulting in attacks where users lose funds. Using Imua crypto economic security, bridges can more securely validate transactions and commitments as if they were natively on-chain. Oracle data has a high degree of subjectivity, which may require intervention with regard to slashing conditions. Imua’s dedicated social consensus of independent validators can help with dispute resolution should a slashing condition ever be vetoed.

- Healthy DeFi markets also need lending platforms, which require collateral that increases cost of capital. Using Imua economic security to validate credible commitments in lending and borrowing could reduce the amount of collateral required to participate on the platform.

Cryptographic Networks

Cryptographic networks such as zero-knowledge (ZK) provers/co-processing, fully homomorphic encryption (FHE) networks, multi-party computation (MPC) committees, and trusted execution environment (TEE) networks are starting to grow in importance as they scale within web3 infrastructure. While these networks provide strong cryptographic security guarantees, they often lack incentives to scale in a more decentralized manner.

- Using Imua economic security ZK co-processors can take intensive computations, such as SQL queries, off-chain, generate a ZKP of the result, and bring it back on-chain for use in a smart contract.

- Using Imua economic security could help provide incentives for an MPC protocol to be run by multiple independent non-adversarial entities on separate systems, thus removing a central point of attack.

New Techniques

Imua expands the shared security design space with a few new techniques.

- Restaked Proof-of-Stake (rPoS): rPoS is a novel recursive bootstrapping technique that lets Imua initialize itself as an L1 blockchain network using restaked tokens of existing chains. In that sense Imua will be dogfooding its own protocol using shared security rather than solely relying on the network's native token, $IMUA.

- The Restaking League (TRL): Through Imua, a service can restake their own tokens to help secure other services as a league. The more services in the league, the more decentralized security is available for its members, at a lower cost than singular restaking.

- Enshrined Oracle Module: The Oracle module is a fundamental component of Imua, facilitating fair and accurate pricing for standardized voting power calculations. By aggregating consensus prices from validators and offering price queries for registered asset pairs, this module underpins Imua’s multi-token restaking functionality and consensus system. Through providing the fair price of restaked tokens, the oracle module is also crucial for the smooth operation of other Imua functionality, such as block production, reward distribution, penalty enforcement, and service participant weight calculations

- [REDACTED]: We're cooking something new to be announced in early 2025

Gmua, World

Imua invites everyone from any corner of the world to help move the industry forward and extend crypto everywhere.

For updates and announcements, follow us @Imua on 𝕏, join us on Telegram and Discord.

“Imua!”